Equally investors and borrowers alike stand to get from using a P2P company. Let us assessment Many of these Advantages.

In that case, you'd visit a traditional lending establishment (a financial institution or credit history union) and talk with a loan officer who might say "Sure" or "no" after crunching numbers. To invest, you'd also undergo a traditional broker — on the web or in-man or woman. Even so, which was before.

Some or every one of the solutions/services listed on this web page are from our affiliate partners from which we receive commissions. This, having said that, isn't going to affect the evaluations inside our critiques. Learn more by studying our Advertiser Disclosure.

Homeowners insurance policy guideHome insurance ratesHome insurance coverage quotesBest property insurance companiesHome insurance coverage procedures and coverageHome insurance policies calculatorHome insurance policies assessments

When buyers supply cash to borrowers specifically utilizing a P2P System, most economical assistance vendors charge no overheads. This way, both get-togethers get benefits.

Once the mortgage will get all the resources, the borrower requirements to simply accept the conditions and terms for his mortgage. The app costs an amount within the borrower although transferring revenue in the borrower’s account.

The stock sector goes up and down like a roller coaster – often violently – but smooths out eventually. The lengthier you continue to be invested, the greater your chance of strong returns.

The System is quite large, giving you the choice to control quite a bit of your funds all in a single spot, together with any own loans you might have to have

It obligates the lending organization to get back the bank loan or declare proper from your investor Should the borrower defaults. But When the lending business goes bust the assure is often useless.

Getting specific stocks might be exciting because you get to personal a piece of businesses you love. However it’s also the riskiest style of inventory current market investing.

When applying for financing by means of Funding Circle, you should also Remember the fact that this substitute lending web page needs a private guarantee and a lien on your organization assets, which may incorporate stock, equipment, and cars.

Many of the Peer-to-Peer lending apps in Europe work in exactly the same way. Listed here are The everyday steps for signing up and employing a P2P lending app as an investor:

This is due to The truth that the claim is in opposition to the personal loan business instead of the platform by itself in the event that items go south.

As the most effective particular financial loan companies, Prosper lets its prospects make use of the funding for many more info different uses, like dwelling improvement, debt consolidation, getting a vehicle or other vehicle, engagement ring funding, and tiny organization funding. By way of this lending marketplace, It's also possible to get out a environmentally friendly bank loan or maybe a armed forces personal loan.

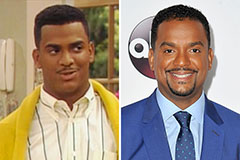

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Talia Balsam Then & Now!

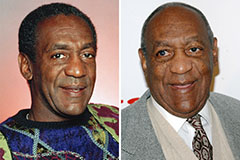

Talia Balsam Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!